does cash app report to irs reddit

For most zelle venmo and cash app. I never received any stimulus payments.

Starting January 1 2022 Cash App Business Transactions Of More Than 600 Will Need To Be Reported To The Irs R Cryptocurrency

Other destination countries and currencies are not supported by Cash To make cross border payments with Cash App both the sender and the recipient need their own Cash App accounts.

. And its ridiculously difficulty to get in touch with support because the support that the app offers is not the same as. Sorry I meant dont file your taxes with Cash App Taxes. You can use your Cash App account to send money from the US to the UK or vice versa.

Ohh Im sorry yes Apple Cash. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. RCashApp is for discussion regarding Cash App on iOS and Android devices.

Because of this Ive decided to build Instant Notion a free iOS app which makes adding tagged notes super pleasant quick. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. You can take notes without internet access they will be saved later I love using this in Berlin.

Im just gonna leave this here since i know its different for everyone but i had my taxes accepted a day after filing with cashapp. Op 18 days ago. I didnt mean avoid having your tax refund deposited to a Cash App account.

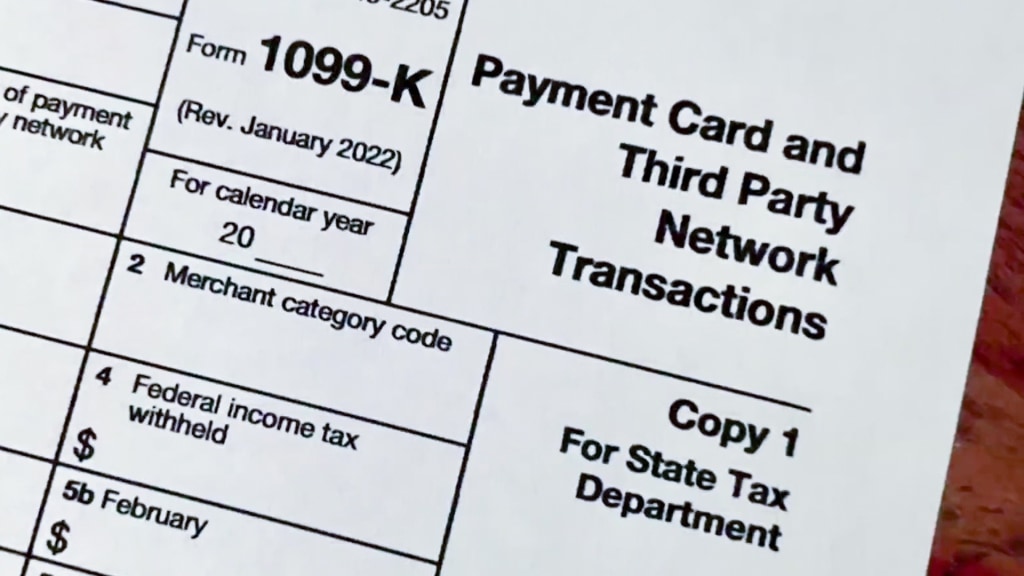

Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. Many people who use zelle venmo and cash app have been shocked to check that the irs now wishes to find out about large transactions. The refund status page provided an extension number for contacting them.

18 days ago. Im using cash app to receive my refund which is scheduled for 69. I confirmed this by logging into the IRS account and checking under economic impact payments.

As a result the IRS has put regulations in place for recording cash app payments. 1 mobile payment apps like venmo paypal zelle and cash app are required to report commercial transactions totaling more than 600 a year to the irs. New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain payment transactions that.

Does cash app report personal accounts to irs reddit. Anyone sending money to another Zelle user account must be aware of the recipients email and mobile number. But the thing is it works.

This still hasnt been reflected on the IRS website after almost 2 weeks now. You have to report payments of 20000. RCashApp is for discussion regarding Cash App on iOS and Android devices.

Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600 annually. Apps cash apps like venmo and paypal now required to report 600 transactions to the irs. Cash app taxes debuted five years ago under the name credit karma tax.

This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Its high on functionality but low on design. What Does Cash App Report to the IRS.

However in Jan. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. So what does Cash App report to the IRS anyway.

Cash App is like five apps in one stripped-down easy-to-use package. It fetches tags from your multi-select property - secure. However IRS amended the tax return and deducted 1400 from the expected refund.

The answer is very simple. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for the change some claiming a new tax. However I see multiple other people that received their refunds already with the same DDD as me but they used NetSpend chime etc.

Cash app does not deposit on the weekend. Make sure you fill that form out. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service.

Oct 05 2021 The threshold for Cash app payments drastically lowered starting Jan 1 2022. Investment decisions should be based on an evaluation of your own personal financial situation needs risk tolerance and investment objectives. Currently the IRS has rules for cash app payments.

Contact a tax expert or visit the IRS website for more information on taxes. Posting Cashtag Permanent Ban. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS.

This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. All three of these digital payment channels are now accepted by a lot of businesses.

Posting Cashtag Permanent Ban. Although here were just mainly interested Cash Apps direct involvement in the Bitcoin market. Please clarify if you mean Apple Pay Cash which is different from Apple Pay at merchants.

A student organization i was in used cashapp to pay for dues 50kish and the treasurer got audited by the irs who thought it was his personal income. Personal Cash App accounts are exempt from the new 600 reporting rule. Federal Tax Refund E-File Status Question.

IRS account transcript shows code 766 for 1400. Notes go straight from your device to Notion thought the official API - works offline. If the reviews and complaints here on.

A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account. Cash App formerly known as Squarecash is a peer-to-peer money transfer service hosted by Square Inc. 2022 the rule changed.

Do you think cash app will post mine Tom. Cash App formerly known as Squarecash is a peer-to-peer money transfer service hosted by Square Inc. On reddit forums one poster said time to squeeze the little guy dry some more another user said.

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Does Coinbase Report The Irs Koinly

Track Mileage Free Using The Free Stride App Tracking Mileage Download Free App App

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Reporting Income On Stolen Property Can Someone Explain This R Irs

Report Your Illegal Income To Irs This Is 100 Real Source Https Www Irs Gov Publications P17 R Cringepics

Yes Irs Asked Taxpayers To Claim Stolen Items And Illegal Income Snopes Com

Can Cash App Transactions Be Traced By The Irs And Police How To Track Your Cash App Card

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Here S Why Your Tax Return May Be Flagged By The Irs

Apps To Report Payments Over 600 Per Year To The Irs R Bitcoin

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Does Robinhood Report To Irs Wealth Quint

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy